The Current Reality of Budget & Taxes: A Must Read

As your City Councillor, if you only read one of my posts this month, I recommend reading this one. Transparency about our budget is essential - especially considering the challenges and difficult decisions ahead. Today City Council received a presentation from Administration on budget forecasting as part of the preparation for when Council sets the 4 year budget (2023-2026) this fall.

The presentation we received today highlights forecasting scenarios for deciding the City’s priorities, funding, and a breakdown for operational and capital budgets.

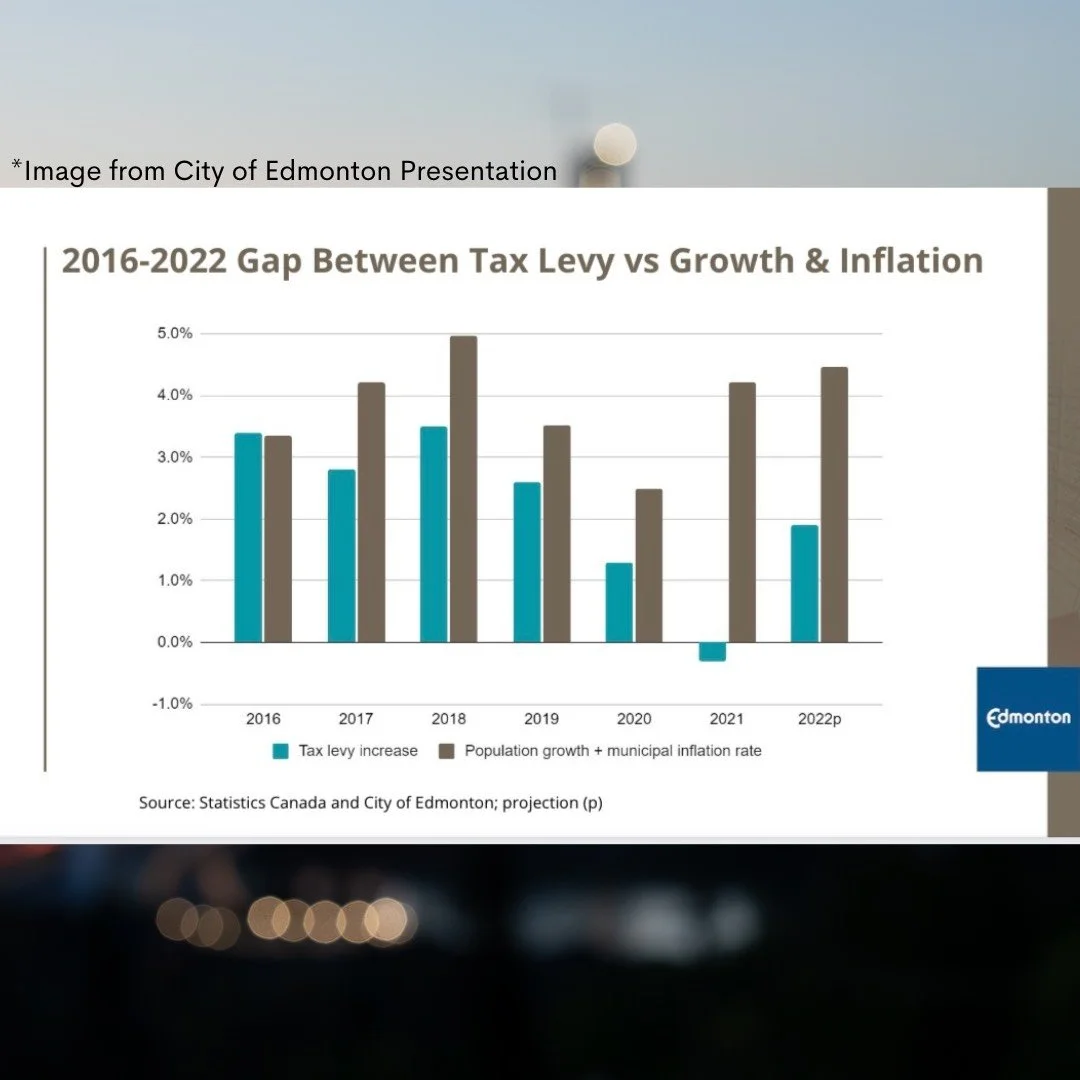

The tax levy increases since 2016 have not kept pace with population growth and inflation creating a compound effect we are seeing in this report. Administration highlighted that in previous years, the City offset higher tax increases through finding efficiencies within the system. Ultimately, this resulted in reductions in service without tax supported increases - snow and ice operations being an example.

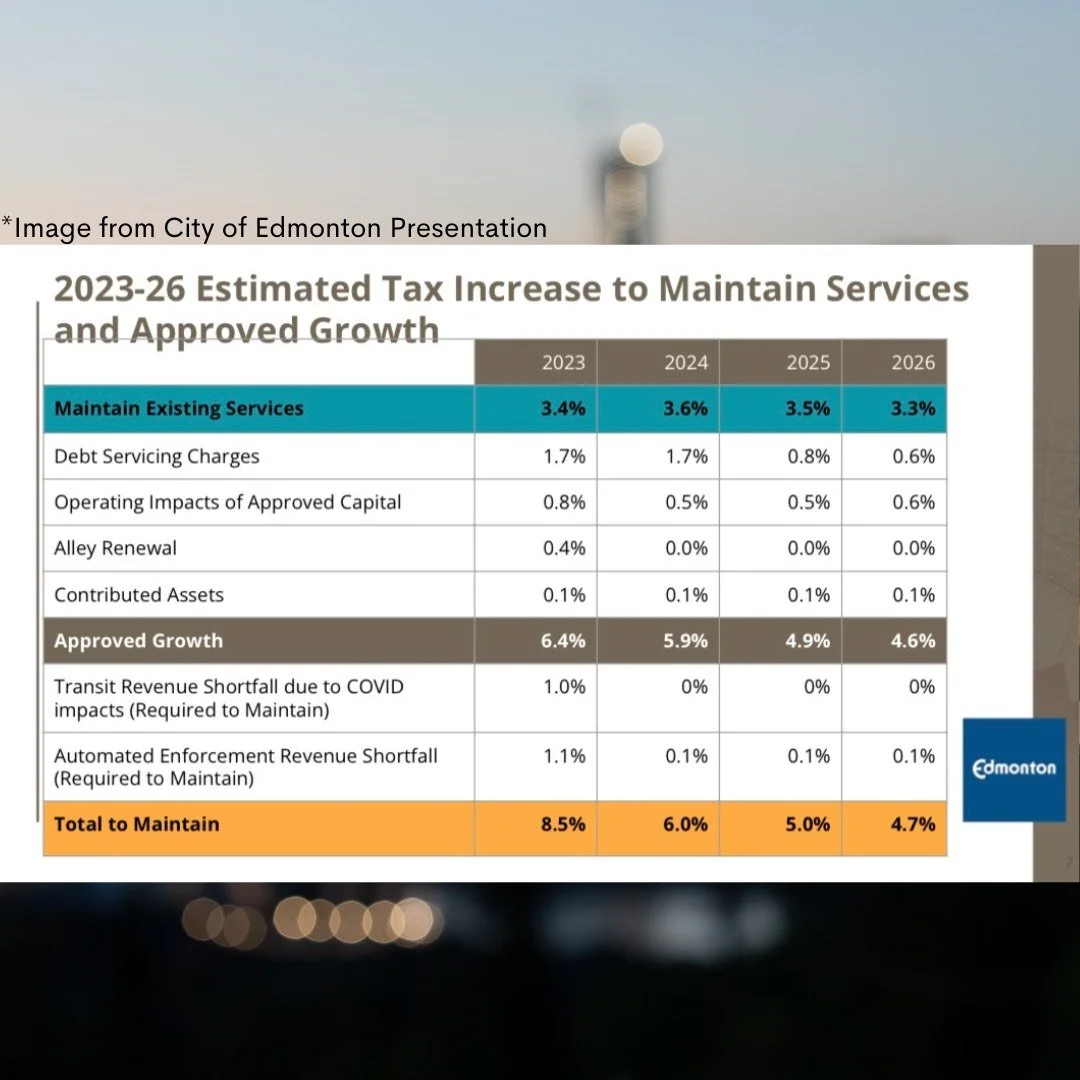

In order to maintain service levels each year, at a MINIMUM, tax levy increases need to keep pace with inflation and population growth each year. The stark current reality is that in order to MAINTAIN CURRENT SERVICE LEVELS, once population growth and inflation are factored in, the projection for 2023-2026 tax increases for each year are respectively 3.4%, 3.6%, 3.5%, and 3.3%. These rates would NOT include any growth or service increases to areas such as Snow and Ice, Climate Action & Energy Transition Strategy, Police Funding, Mass Transit Plan, and more.

I spoke a lot about taxes during my campaign and how at the civic level, municipalities are more limited than other levels of government in terms of tools for revenue generation. Municipalities are also not permitted to run deficits on their operating budgets. This budget forecast is particularly challenging given that Edmonton is receiving REDUCTIONS IN FUNDING from Alberta’s Provincial Government. As a result, cities are forced to make up the shortfall but with significant limits on where and how they can generate revenue.

Once GROWTH is factored in (both operating and capital expenditures), including core services such as road maintenance, snow and ice, recreation, transit, etc., the estimated tax levies for 2023-2026 are further increases. This scenario highlights how essential it is for the true cost of growth to be considered when we are building new developments.

These numbers are based on current available data and projections on available funding.

We need to have tough and honest conversations about priorities and what is important and what we can see less of. I’ve heard that many folks are struggling to keep up with the cost of living. I’ve also heard increased demand for enhancing service levels and preparing for future growth. I believe a balanced approach to tax increases is fiscally prudent. We need to balance our current reality while also preparing for the future. And we need to ensure we are supporting a strong and vibrant city with services and amenities we can be proud of.

In terms of next steps, City Administration will be conducting public engagement opportunities this summer and I’ll share more information as it comes available. And as always, I welcome your feedback to my office and I will also host specific events focused on budget.

What do you think we should do more of, less of, or make sure we maintain?