Spring Budget Adjustment

I recognize that many households and businesses are facing increased costs on many fronts. The City is experiencing many of these same cost pressures - including growth, inflation, and changing funding from other orders of government.

The City of Edmonton does budgeting on a 4 year cycle (2023-2026), with 2 adjustments a year; spring and fall.

The budget supports 70 city services. This includes emergency services like police and fire, parks, roads, trails, bridges, recreation centers, attractions, social supports and transit. It also covers capital renewal and growth in key areas such as safety (e.g, new fire halls).

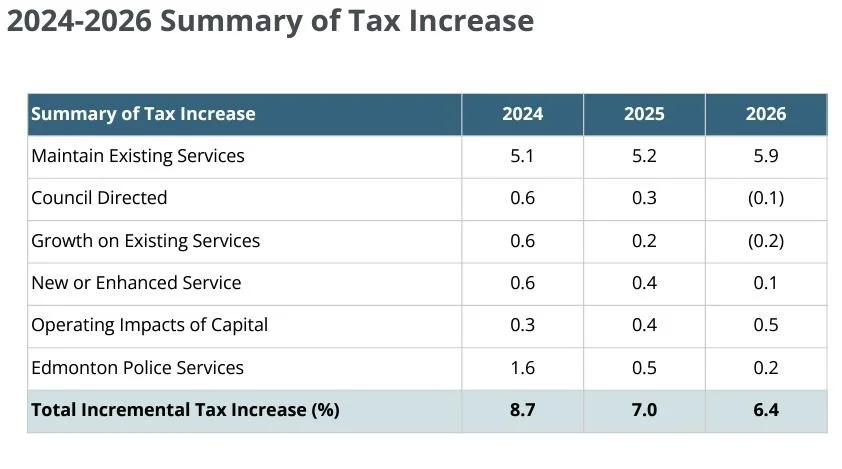

Since the fall 2023 budget adjustment, we’ve encountered higher benefit premiums and now have a better understanding of longer-term labour costs. Administration is recommending a property tax increase of 8.7% (up 2.1% from the budget set in fall).

The spring budget adjustments taking place in April are not meant to re-debate the entire 4 year budget. These adjustments are for unknowns or changes in projected costs/revenues (such as changes in funding from other orders of government and other cost pressures).

So how’d we get here? There are several cumulative factors that are important to note in this discussion.

During the pandemic, planned tax increases were reduced to 1.3% in 2020, 0% in 2021 and 1.9% in 2022 to ease the tax burden for Edmontonians who were facing economic hardships. To achieve no increase in 2021, $50 million in reductions were made, including program changes, efficiencies, staff reductions and temporary facility closures.

In 2022, our 1.9 per cent tax increase was the lowest among major Canadian municipalities. Unfortunately, these low tax increases just aren’t sustainable. Likewise, substantial annual tax increases are also not sustainable for households.

The challenge before us is how to deal with the cost pressures and without resorting to erosion of core city services.

Within the timeframe of the spring budget adjustment coming up next week, Council’s choices are between funding these pressures through increased property taxes, increasing user fees, or by reducing services to keep taxes lower.

The challenge is that we have already reduced many programs and services throughout the last several years and adjustments to-date and our Financial Stabilization Reserve needs to be replenished. Further, even a combination of all of these would not bring the budget down in any significant way. In my conversations with residents, I haven't heard a desire for less services, but rather for enhancements (such as improved snow clearing, more recreation centers, more funding for safety, better maintenance of capital).

The current tax increase is largely attributed to simply maintaining existing service and the costs that go with this.

*Image from presentation prior to Spring Budget Adjustment in which 8.9% was approved for 2024.

Additionally, operating expenses (like programs and services) have the biggest impact on tax increases. Capital expenses on the other hand (like infrastructure projects - roads, buildings, bike lanes, bridges) do not impact the tax increase as much.

I often hear suggestions to stop certain capital projects. However, stopping capital projects that are beyond a certain point has financial, reputational, and partnership risks. In other words, we simply can’t stop projects underway as it would not result in savings.

Regardless of the decision at the Spring Budget discussions, there remains tension with maintaining services that many Edmontonians rely on while also balancing growth for a rapidly expanding and growing city.

What are your thoughts on this? Are there programs/services/areas you think the city should reconsider?

Read the other blogs in this series…

Before Considering a Tax Increase